NEW: Launch Annex Products the Simple and Successful Way

Many businesses – such as telecom-providers, retailers or banks – have a substantial customer base and enjoy their customer’s confidence.

This confidence is a great value and should be utilized to open up new revenue sources.

Therefore, offering annex products alongside primary products makes a lot of sense. A lucrative way of doing so is to distribute insurances. However, including insurance products in your own portfolio, does come with quite some obstacles. Fortunately, Anivo has developed an innovative online-solution to make it work: a white-label-insurance platform.

Successfully offer insurances as annex products.

What are the greatest obstacles?

Selling insurance is a challenge. How come?

The insurance market is heavily regulated Selling insurance products requires a license. In Switzerland, for instance, the Swiss Financial Market Supervisory Authority FINMA monitors the insurance market.

Insurance products are complex The technological implementation, in compliance with all legal requirements, demands considerable effort and occupies valuable IT-employee’s time. A resource usually found to be very limited.

Often underestimated: training and instruction of employees Initial training of a sales team on insurance products is cumbersome and time consuming. Specially trained and certified insurance experts are required. Getting the team on the track of success and keeping them there is a whole other challenge.

Our solution: White-label insurance platform for annex products.

Our all-in-one package offers simple and fast onboarding and acquisition-as-a-service.

Anivo 360 AG has developed a solution that solves the problems outlined above and enables businesses to increase customer margins easily. The solution consists in a white-label-platform for distributing insurances as annex products, that can be adjusted flexibly:

Degree of integration

The various degrees of integration span from a low level of integration (e.g. simple standalone web-application) to a full integration (customer-journey in corporate branding).

Consulting approaches

- Self-service – Customers simply complete their insurance online.

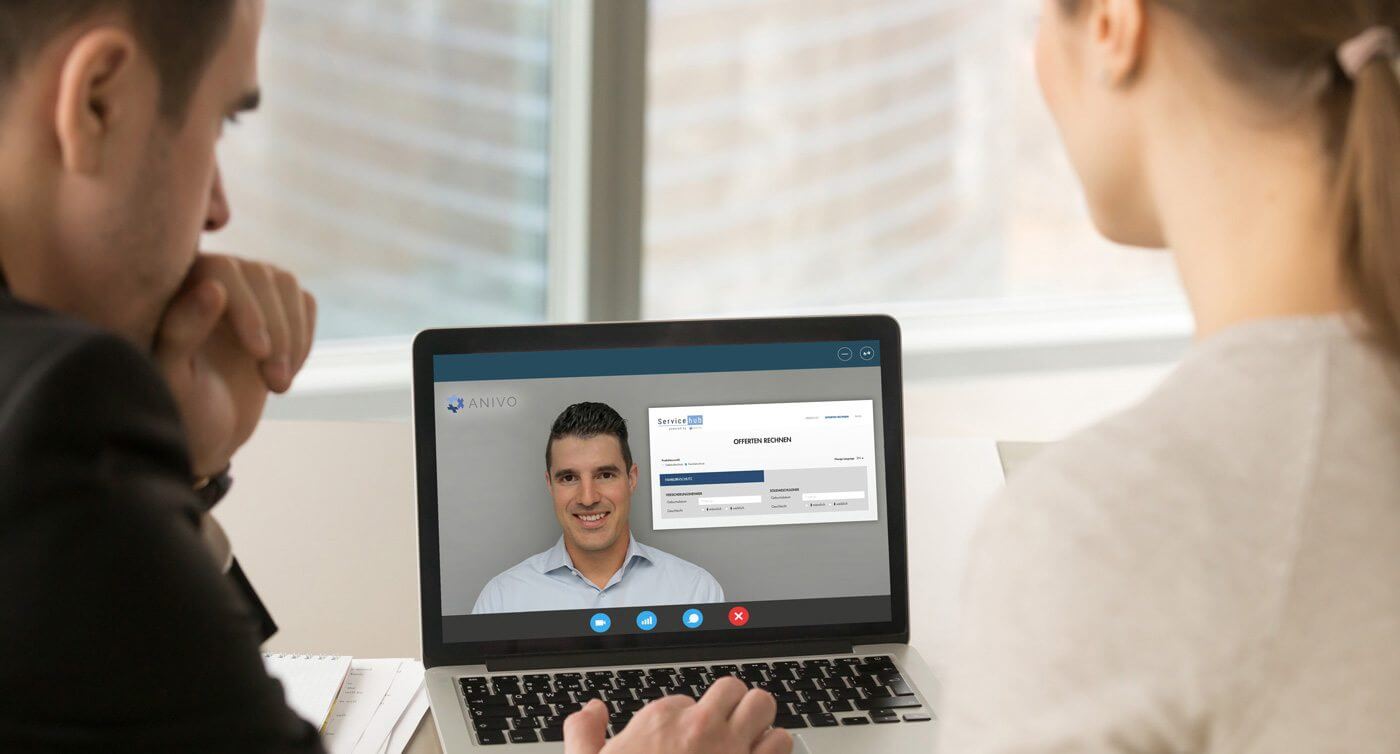

- Personal consultation via phone, chat or video-call with certified Anivo insurance experts: The advisory- and sales personnel doesn’t need to have any special insurance know-how. Your employee can simply start a video call with an Anivo insurance expert during a meeting with the customer (Acquisition-as-a-Service). The Anivo-adviser will then configure the ideal insurance solution for the customer in real time. The conclusion of the insurance contract takes place paper-free during the video conversation.

Concluding the insurance policy

The contract can be concluded in different ways: It is possible to issue a nonbinding offer which is signed later on, or the insurance contract can be signed directly within the online transaction.

All involved parties benefit

Benefits for businesses

- Establish a new, additional source of revenue.

- Higher customer loyalty through additional offers.

- No special insurance knowledge and virtually no employee training is required.

- Plug&Play: Simple and uncomplicated one-stop onboarding within a short period of time.

Benefits for participating insurance companies

- Insurances can establish a new distribution channel with very little effort.

- White-label insurance platform that can be adapted flexibly to different insurance products.

- Development and implementation of new products without having to make changes to the core system of the insurance.

- Quick and simple implementation.

- Field sales can be carried out by a call center or outsourced to Anivo.

Benefits for end customers

- At precisely the right moment, along with the information on the primary product, the customer receives an individual insurance product, which covers the risks that arise from purchasing the primary product.

- The innovative insurance solutions are developed from the customer’s point of view and offer real added value. For instance: simple & transparent, online policy conclusion and monthly cancellation.

- Convenient for retail- and online customers: Receive the fitting annex product from the same source. Based on experience, the success rate is very high.

Example of use, Bank-assurance:

BLKB, Basler Versicherungen and Anivo develop insurance solution for mortgage customers

BLKB Bancassurance offers two annex products and is based on the new Anivo white-label platform. It was first presented to the public on 07.03.2018 and a service unseen before in Switzerland.

Basellandschaftliche Kantonalbank (BLKB), Basler Versicherungen and insurance broker Anivo have developed two new insurance products for mortgage customers.Servicehub AG, a newly established subsidiary of the BLKB, oversees distribution. Going forward, there are plans for Servicehub AG to offer their services to other banks. They will be offering their consultancy services and products to other retail banks as an all-in-one package.

→ Find out more: read the press release for the product launch

Interested in finding out more about the distribution of annex products?

Yes! Get in touch with me. I would like to be informed first-hand about innovative ways of insurance sales.