Analysis of insurance sales using video telephony

e-foresight recommends the Anivo Bancassurance approach to Swiss banks for examination.

Anivo together with Servicehub AG – a subsidiary of Basellandscahftliche Kantonalbank (BLKB) one of the bigger Swiss cantonal banks – launched a very promising new bancassurance approach in March 2018. The solution became the most successful bancassurance solution in Switzerland within a year. This success aroused e-foresight’s interest

e-foresight is an independent digital banking think tank from Swisscom and focuses on the digital transformation of the Swiss financial industry. The experts subjected the Anivo Bancassurance solution to an intensive analysis.

The result was presented in a start-up portrait “Insurance distribution via video telephony” and is very encouraging for Anivo. The complete article is exclusively available to e-foresight customers. Below you will find a summary containing a recommended course of action for Swiss banks.

Bancassurance – Remedy against margin erosion within the banking business

Many banks are currently suffering from margin erosion. Bancassurance is seen as an effective means of countering falling profits. Without naming names – the last attempts of major players in Switzerland were unfortunately not rewarded with great success.

Bancassurance approaches, which separate product distribution from advisory services, are currently considered by e-foresight to have a fundamentally better chance of success. BLKB is the first bank in Switzerland to pursue such a concept and to offer its customers a complete mortgage protection solution. e-foresight sees the cross-sector approach of remote insurance consulting via video telephony as “particularly innovative”.

Bancassurance makes a comeback in a new form

In any case, e-foresight sees a comeback of bancassurance in a new form. The bank advisor no longer becomes a financial all-rounder who sells insurance products in addition to bank products, but instead consults an external insurance expert for advice if required. This can increase the number of useful touchpoints and increase the loyalty and satisfaction of bank customers.

Increase in interest-differential business practically without investments

This in turn leads to a possible increase in the interest-differential business of 3 to 5 basis points of the mortgage margin. E-foresight also found that the Anivo solution’s conversion rate is well above the industry average. The consulting rooms in the branches must be equipped with the necessary modern infrastructure (screen, audio). The bank advisors need basic training on how to make their customers aware of the risks associated with their real estate. Further financial investments are not necessary.

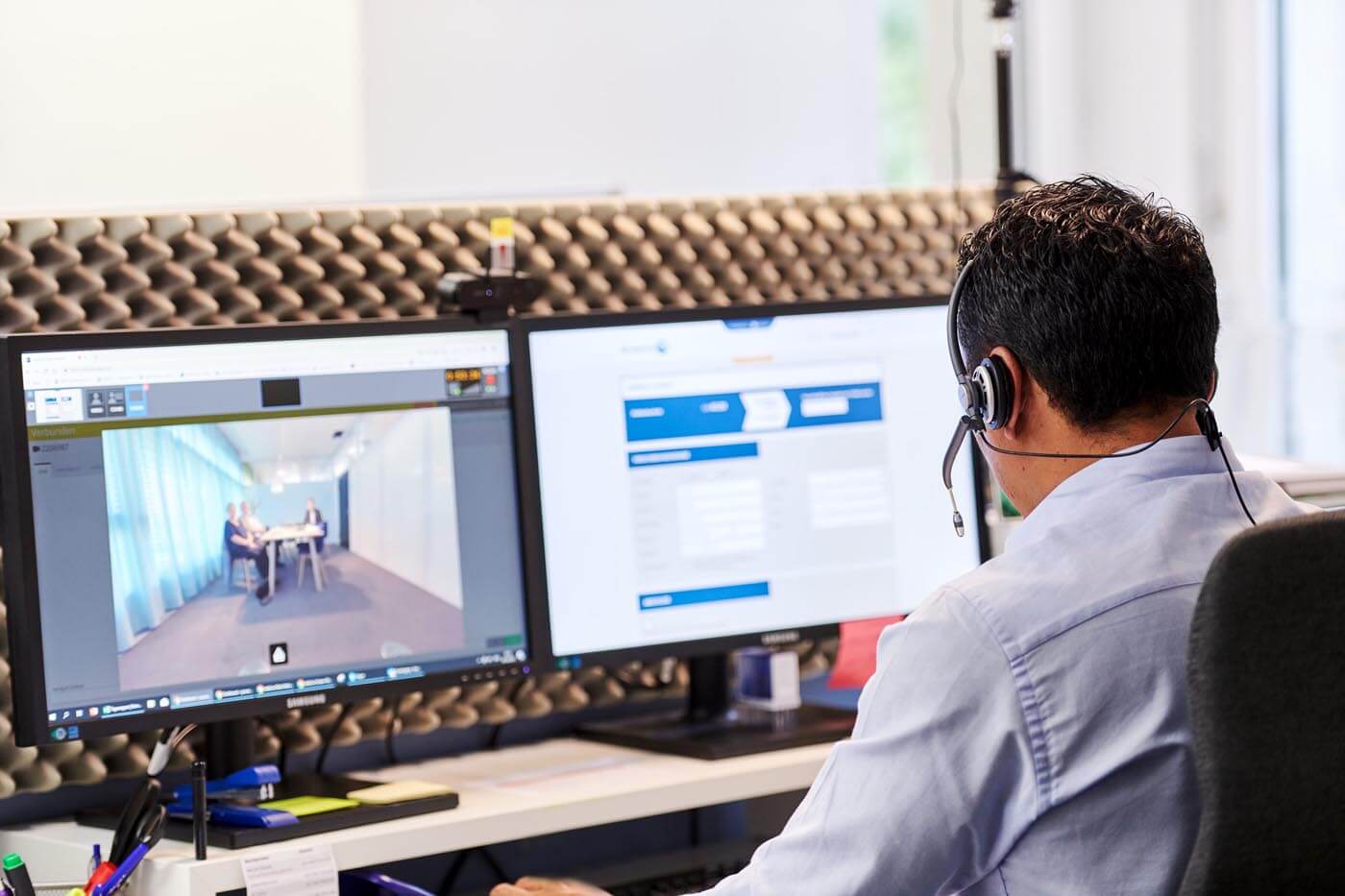

Anivo Insurance expert during video consultation with bank clients and bank consultant

e-foresight recommends Swiss banks to evaluate this bancassurance solution

With the Anivo solution, banks can offer their customers supplementary products and services relating to real estate and position themselves in the insurance sector. In the near future, remote consulting will also be possible without visiting a branch. This is particularly interesting for banks with very tight interest margins (e.g. online mortgages). Retail banks can quickly build up a promising bancassurance product portfolio in real estate-related areas.

Use of the model possible with or without existing insurance partnership

A partnership with an insurance company is not necessary. Banks with an existing insurance partnership should critically compare the efficiency of their solution with the Anivo solution – also taking into account the capabilities of their customer advisors. The model can also be used in parallel to existing partnerships.

Unique technology

According to e-foresight, “a direct copy of the model will not be feasible for banks without further ado. This is because the AnivoCore technology used is unique in its class to date, and secondly because the project expenditure of around 18-24 months cannot be neglected.

Thanks for the image to Julian Hacker on Pixabay