Successful Bancassurance Use Case

How established insurers can solve their innovation dilemma

In times like these, traditional banks and insurance companies have to defend their positions against aggressive start-ups and are under pressure to take action. They have to start innovating themselves – but they are faced with the dilemma that their existing business is tying up scarce IT resources. Compared to other European countries, the distribution of insurance products via banks in German-speaking countries has not yet become widespread.

With the Basellandschaftliche Kantonalbank, Anivo 360 AG successfully implemented a bancassurance solution in a very short time, the results of which exceed the expectations of the project partners. The technological basis of the solution is AnivoCore.

In this way, not only banks and ecosystem partners, but also insurers are offered the opportunity to map new insurance products technologically within weeks and roll them out broadly without having to strain their own IT resources.

Many banks are currently asking themselves what role they want to play in the lives of their customers in the future. Will it be enough to offer the classic banking products and services to distinguish oneself from digital “attacker banks” such as Revolut or N26? How does a bank still earn money when, for example, payment transactions, foreign currency transactions or trading in ETF products are suddenly offered free of charge by new market participants? How does a bank keep its customer relationships alive if, for example, mortgages are increasingly bought through intermediaries? And how does a bank reposition itself when customers are less and less willing to visit a bank branch?

Possible answers to these questions and what all this means to the innovation dilemma of insurers can be found in this article.

One way for banks to increase customer loyalty and generate additional revenue at the same time is to sell additional services and products such as insurance. The banking and insurance sectors are related to each other to the extent that both offer financial products. Bank advisors are well trained in financial matters. On the face of it, one could therefore assume that it should be easy for them to explain insurance products to their customers and sell policies accordingly.

Reality, however, speaks a different language. In Germany, Austria and Switzerland, bancassurance has not yet been able to gain acceptance. The study “Introduction to Bancassurance” recently published by the Institute of Insurance Economics (I.VW-HSG) shows that in countries such as Portugal, Italy, Turkey and France bancassurance plays a much larger role in insurance sales with up to 80 percent market share. The approach therefore may well work. But why not in German-speaking countries?

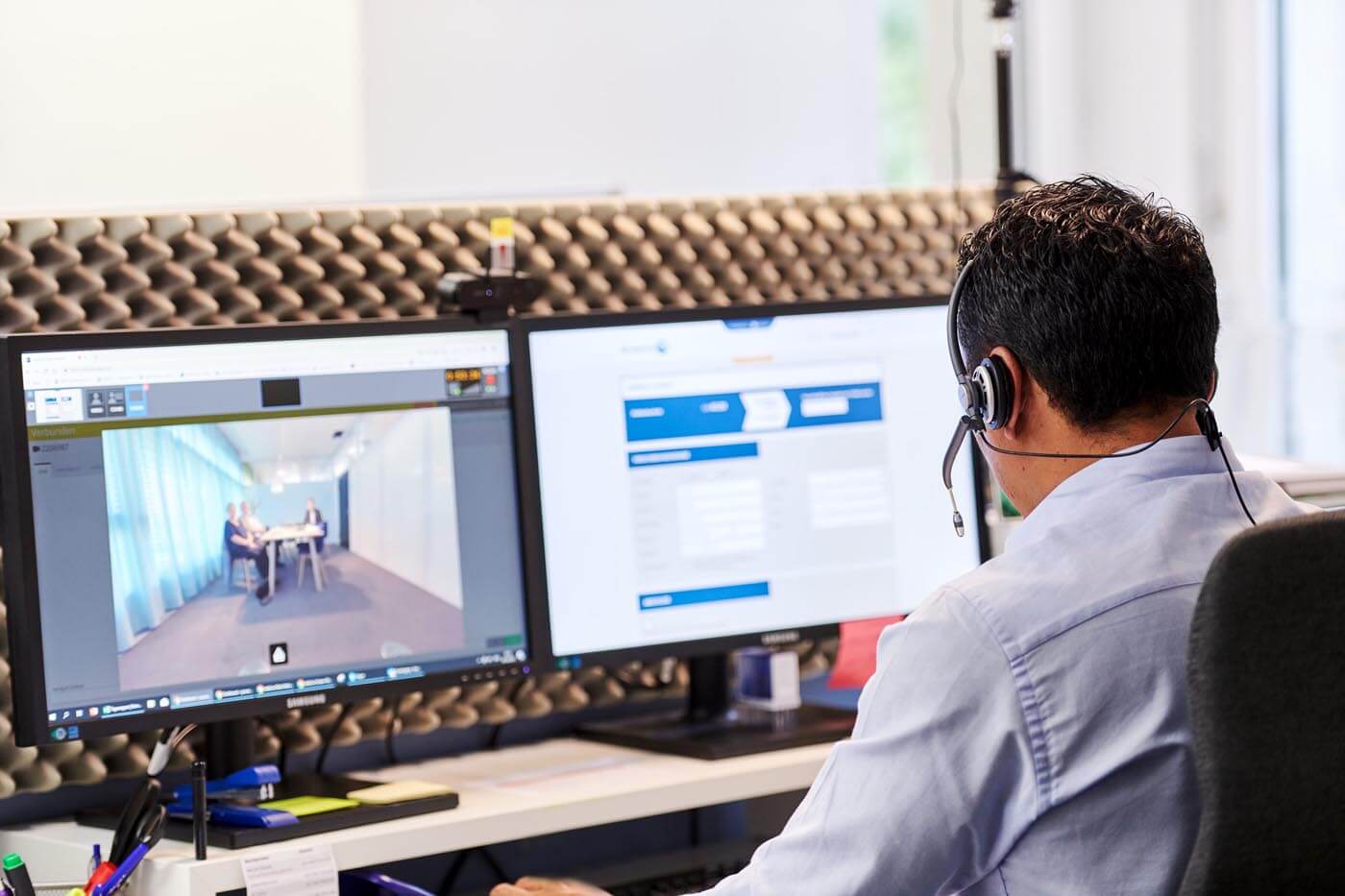

Anivo insurance expert in video call with bank customer and bank advisor

To answer this question, Basellandschaftliche Kantonalbank (BLKB) – a leading Swiss cantonal bank with a balance sheet total of CHF 24 billion – and Anivo 360 AG (Anivo) – an Insurtech with locations in Switzerland and Austria – have entered into a cooperation. While the first step was to investigate the reasons why bancassurance in Switzerland has failed so far, the second step was to develop a workable solution that delivers real added value for customers.

Three problem areas

were identified

three problem areas and thus fields of action:

Field of action 1: The insurance product

Selling conventional standardised insurance products via the bank using a push approach does not provide any significant benefit to the customers of a bank. On the contrary, it can happen very quickly that customers get the impression that their bank advisor, whom they have great confidence in, wants to “sell” them insurance that they can obtain just as well (or even better and cheaper) via their insurance agent or a price comparison platform.

It is therefore essential to deal with customers, their life situation – for example when buying or renewing a mortgage – and their related worries and needs, and to develop appropriate products that meet individual situations of customers. The starting point for such considerations is ideally always a specific customer need, and not the opinion of the product development department, the possibilities of IT or the existing product range.

Field of action 2: The advisory process

The higher the cost of an insurance product from a consumer’s point of view, the safer he wants to be when buying a policy to make a good decision. Comprehensive protection of the mortgage and the related property is associated with annual costs of several hundred francs and therefore requires intensive advice.

Bank advisors often have only limited insurance know-how and do not want to risk the trust of their customers carelessly if they run out of answers to their questions about insurance products too quickly.

Field of action 3: Integration

For banks, the classic integration of insurance products into the existing process and IT landscape is a major challenge. Insurance companies also have great difficulty implementing new products and processes in a reasonable time – and then continuously improving them.

From a technological point of view, an integration approach is needed that can be implemented as resource-efficiently as possible for both the bank and the insurance company. Otherwise, joint projects could fail as early as the conception phase.

New

holistic

approach

Based on the findings of the joint analysis, the cooperation partners BLKB and Anivo developed two completely new insurance products together with Baloise Insurance in the context of purchasing residential property. Using Anivo technology, both products were designed, calculated and technically implemented within twelve weeks. One product provides comprehensive protection for real estate, the other ensures that the mortgage continues to be paid in the event of unforeseeable events such as death, unemployment or separation – both products that were previously unavailable on the Swiss market.

Special innovation:

Customers are granted a monthly right of termination. The premiums for both products can be calculated using only four parameters for the building or family situation.

Special innovation:

The insurance is taken out without signature. The video proof of a verbal declaration of intent by the customer is sufficient. The customer receives the insurance policy by e-mail immediately at the end of the consultation.

The consultation process was structured as follows: The bank advisor discusses possible risks with his clients in the course of a regular mortgage consultation. If a customer shows interest, the bank advisor consults an insurance expert from Anivo live via video call. The bank will give notice of the relevant consultation in advance. The Anivo insurance expert discusses the personal life situation with the customer and gets a picture of the property. Based on this, he offers the customer appropriate insurance products and configures them directly on the screen.

Results after

half a year

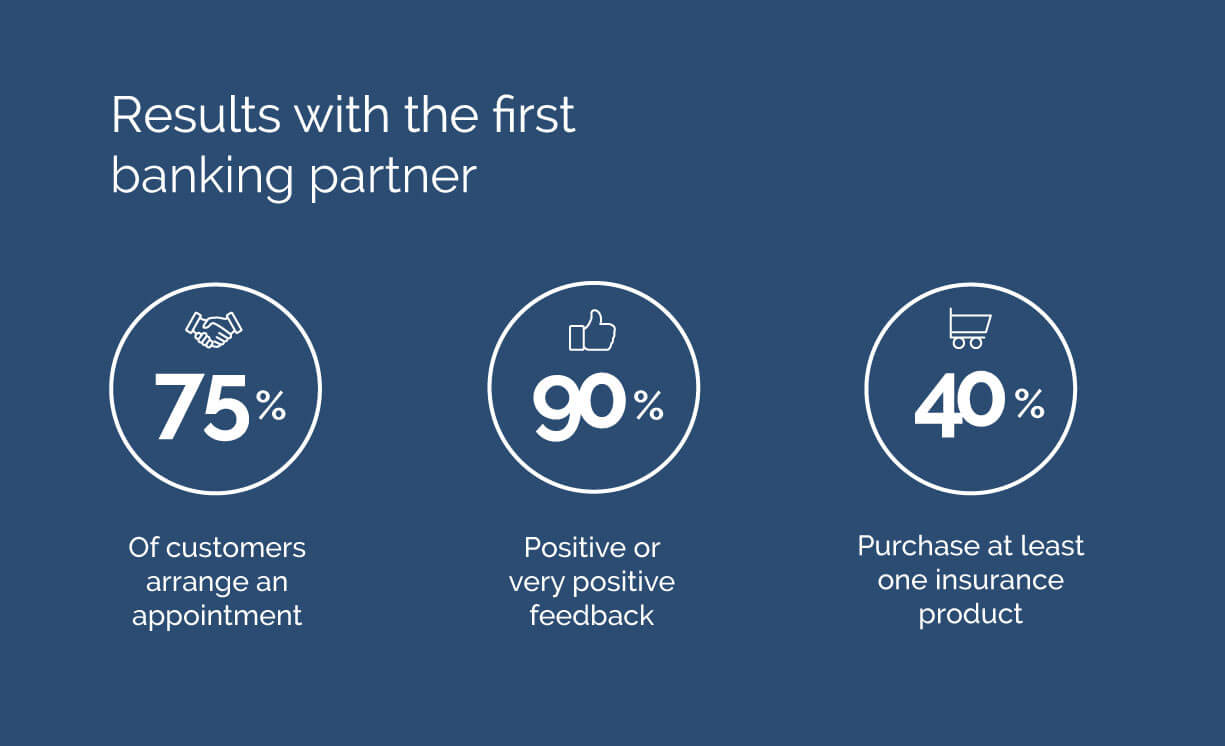

Since its launch in April 2018, around 2,500 consultations have been conducted to date. The results exceed the expectations of all participants (see charts).

Results above expectations of all stakeholders

- Hedging risks in connection with residential property is of the utmost relevance for BLKB’s customers. They are also happy to come to the bank branch for this. From a banking perspective, this is highly relevant in terms of the number of personal touchpoints with customers, customer loyalty and the opportunity to address other issues.

- The innovative advisory approach of connecting an insurance expert to the bank advisor during the bank consultation via video conversation is widely accepted by bank customers. They receive highly professional insurance advice while their bank advisor gives them the last assurance that they are making a good decision. The solution not only works technically but is also efficient and therefore very economical due to the fact that the insurance advisors are not tied to a specific location.

- The setup and ongoing development of the advisory process and the insurance products are based on the bank’s business transactions. This ensures that the products are relevant, transparent and customer-friendly for bank customers, which leads to excellent contract conclusion rates.

Since the introduction of the solution, the innovative product portfolio has been expanded from two to five insurance products. More than 1,000 BLKB customers have already accepted the offer to protect their residential property comprehensively.

Further bundling solutions for other business transactions and customer segments are currently being developed. In addition, the experience gained in more than 2,500 consulting meetings will be used to develop fully digital solutions that will not only be made available to BLKB, but also to other banks and sales partners.

Insurers in a dilemma

“Run the Business vs. Change the Business”

In recent months, the budgets for 2019 have been discussed in insurance companies and traditionally divided between “run the business” and “change the business”. As a rule, this division is done in a ratio of around 80/20. If an insurer introduces a new policy system, the ratio sometimes shifts in the direction of 95/5. The necessary prioritisation of core resources blocks product and sales innovations for years to come. Those who accept this are probably convinced that the insurance world will not move any further in the coming years.

However, indications are against it: In November 2018 alone, for example, the US-Israeli insurtech Lemonade announced its intention to expand into Europe, and the world’s largest insurance group Ping An has announced that it will invest EUR 41.5 million in the Berlin-based company builder Finleap. Insurance companies must ask themselves how they want to position themselves in a rapidly changing world when new digital ecosystems emerge in a few years and fast, financially strong competitors enter the market.

At the same time, it is vital for insurers to survive: The maintenance of existing customer relationships, the maintenance of existing product portfolios and the renewal of IT systems must not be neglected.

These considerations lead to a dilemma: How can an insurer become successful and innovative at the necessary high speed in the face of limited IT resources that burden the entire industry, especially in terms of human resources, without taking excessive risks?

Promising approach

for insurers

One way to deal with this dilemma could be to cooperate with young technology companies whose sole focus is to bring innovation to the insurance industry.

With AnivoCore, Anivo offers its insurance and reinsurance partners a highly reliable, stable and scalable platform for the development, distribution and operation of insurance solutions based on the latest technologies (see chart).

With AnivoCore, new products from all divisions can be developed and put into operation within a few weeks without affecting existing IT systems. All that is required is a framework agreement in the portfolio management system under which the new policies can be booked.

AnivoCore’s data model was product-centered from the ground up and designed for client operation. Thanks to true multi-client capability, an unlimited number of clients (e.g. various banks, brokers, agents and other sales partners) can be mapped very quickly and easily with the system.

International

partnerships

Anivo 360 AG has proven that the Anivo bancassurance approach and technology work with banks in Switzerland. As a next step, Anivo will use this approach to expand into other European countries.

The Anivo technology platform can be used not only by banks in a single country, but also with one bank (or another distribution partner) across multiple countries.

Insurance companies entering into international or global partnerships face the challenge of having to integrate very heterogeneous local insurance products and IT systems. However, uniform product frameworks, uniform processes and consolidated automatic reporting across national borders are either impossible or very difficult to implement for them. This significantly slows down the introduction of such projects and significantly reduces their profitability. With AnivoCore, multinational solutions can be developed and rolled out very quickly and enable efficient controlling.

This post by Anivo CEO Alexander Bojer was published as a guest article in the journal I.VW Management Information | St. Galler Trendmonitor für Risiko- und Finanzmärkte published by the Institute of Insurance Economics at the University of St. Gallen in issue 04/2018.